Société Générale the trader was involved in an elaborate, yearlong ruse that involved betting billions of dollars of the bank’s money on European stock index futures. Meanwhile, authorities have taken the trader into custody and were suspected to question him in connection with a massive fraud at the bank.

http://www.nytimes.com/2008/01/27/business/worldbusiness/27cnd-bank.html?ex=1359176400&en=1c702cd5a0751054&ei=5124&partner=permalink&exprod=permalink

http://www.nytimes.com/2008/01/27/business/worldbusiness/27trader.html?ex=1359176400&en=7223d2e99adb5e78&ei=5124&partner=permalink&exprod=permalink

Showing posts with label Bond Trader. Show all posts

Showing posts with label Bond Trader. Show all posts

Sunday, January 27, 2008

Friday, January 25, 2008

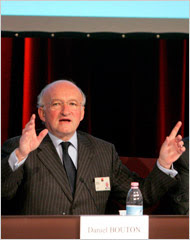

French Bank Says Rogue Trader Lost $7 Billion

By NICOLA CLARK and DAVID JOLLY

Published: January 25, 2008

Société Générale said the trader made bad bets on stocks and then, in trying to cover up those losses, dug himself deeper into a hole.

Société Générale, one of France’s largest and most respected banks, said an unassuming midlevel employee who made about 100,000 euros ($147,000) a year — identified by others as Jérôme Kerviel — managed to evade multiple layers of computer controls and audits for as long as a year, stacking up 4.9 billion euros in losses for the bank.

http://www.nytimes.com/2008/01/25/business/worldbusiness/25bank.html?ex=1359003600&en=bbcb2274324e0855&ei=5124&partner=permalink&exprod=permalink

The $7 billion-man - a finance wizard

PARIS — On the elite trading floors here, where France’s brightest minds devise some of the most complex instruments in global finance, few people noticed Jérôme Kerviel.

He was lucky to be there at all. Many of his colleagues had been plucked from the prestigious Grandes Ecoles — the Harvards and M.I.T.’s of France — and wielded advanced degrees in math or engineering. Mr. Kerviel arrived from business school and started out shuffling paper in the back office.

But on Thursday the world came to know Mr. Kerviel, 31, as the most dangerous accused rogue trader ever, a young gambler who found himself sucked into a spiral of losses that left a $7.2 billion hole in Société Générale, one of France’s largest and most respected banks.

While Société Générale executives maintained that he had acted alone, many questioned how that was possible given the scope of the losses.

http://www.nytimes.com/2008/01/25/business/worldbusiness/25trader.html?ex=1359003600&en=9ac2f0db0525e72a&ei=5124&partner=permalink&exprod=permalink

Subscribe to:

Posts (Atom)

Blog Archive

Alfred Hitchcock's "Foreign Correspondent"

http://myspacetv.com/index.cfm?fuseaction=vids.individual&videoid=10157487